As your business grows, sending emails manually becomes more and more difficult, which is where email flow automation comes in. But where can you get it? We recommend the best email platform, Klaviyo, and in this article, we’ll tell you everything you need to know about what email flows are, their types, and how to set them up.

What Are Klaviyo Email Flows?

Over the years of work, we have become elite partners of Klaviyo, which makes us experienced specialists in this platform. Apart from their other effective services, they are also a leading email marketing automation platform. For ecommerce brands, they provide tools to build complex automated email flows.

Klaviyo email flows are also known as Klaviyo’s automated workflows. Regardless of the name, they are a series of emails that are automatically sent to your customers when they perform certain trigger actions with your store and so on. You can set up automated emails to be sent whenever you want or according to already developed strategies. In other words, send them at any time or personalize them according to customer behavior. Personalization based on customer behavior can be, for example, a reminder of an abandoned cart or a birthday greeting.

Benefits of Klaviyo Email Flows

Now that you know what a Klaviyo email flow is, you need to know more about why you need it and what specific benefits you can gain from it. Take a look at the benefits that can be achieved and in what way.

Email Flows’ Benefits for Businesses

The first thing ecommerce businesses are interested in is the benefits in specific email marketing areas, especially growth statistics in certain branches. Below, we’ll share the general benefits of automated campaigns and Klaviуo’s report on the positive results of their automation:

- An unobtrusive, structured flow can develop and improve relationships with subscribers, turning them into loyal customers.

- Different emails dedicated to a subscriber’s birthday, anniversary, or a special event of your brand establish a semi-personal relationship with the customer, which will remind them of your store and encourage them to return.

- Of course, the most important benefit is increased revenue. Flows remind subscribers about abandoned carts, extend the lifetime value of a subscriber, inform them about different purchase options, and much more.

For more precise guidance, we provide you with data from Klaviyo’s Q422 report, which shows the impressive results companies can achieve when investing in and optimizing Klaviyo flows. These numbers show this growth:

- 52.49% more opens📈

- 5.83% more clicks📈

- 1.82% higher conversion rate📈

- $1.91 average revenue per recipient💲

Beneficial Advantages of Klaviyo

Klaviyo as a platform and software is significantly superior to its competitors in many aspects. However, our topic is specifically about flows, so here we will mention the special advantages of Klaviyo flows over competitive platforms and what benefits they bring.

- Klaviyo provides many opportunities to create automated campaigns. These include a huge collection of ready-made templates and an easy-to-use editor. When you open the template library, first of all, you’ll see the most popular email automation campaigns among ecommerce brands.

- Every ready-made template from Klaviyo has already passed numerous tests, such as A/B testing. If you decide to create your own Klaviyo flow, you can perform testing on it yourself.

- The flow editor is completely user-friendly, it has detailed instructions, and most importantly, it has numerous customizable features that we will also introduce you to.

Best Klaviyo Flows

Klaviyo offers a wide range of customization options for your self-developed flows, while also providing a wide assortment of pre-built flows that have already been built based on customer behavior and have proven to be effective. We have collected all possible examples with every necessary detail so that you don’t have to do any additional research.

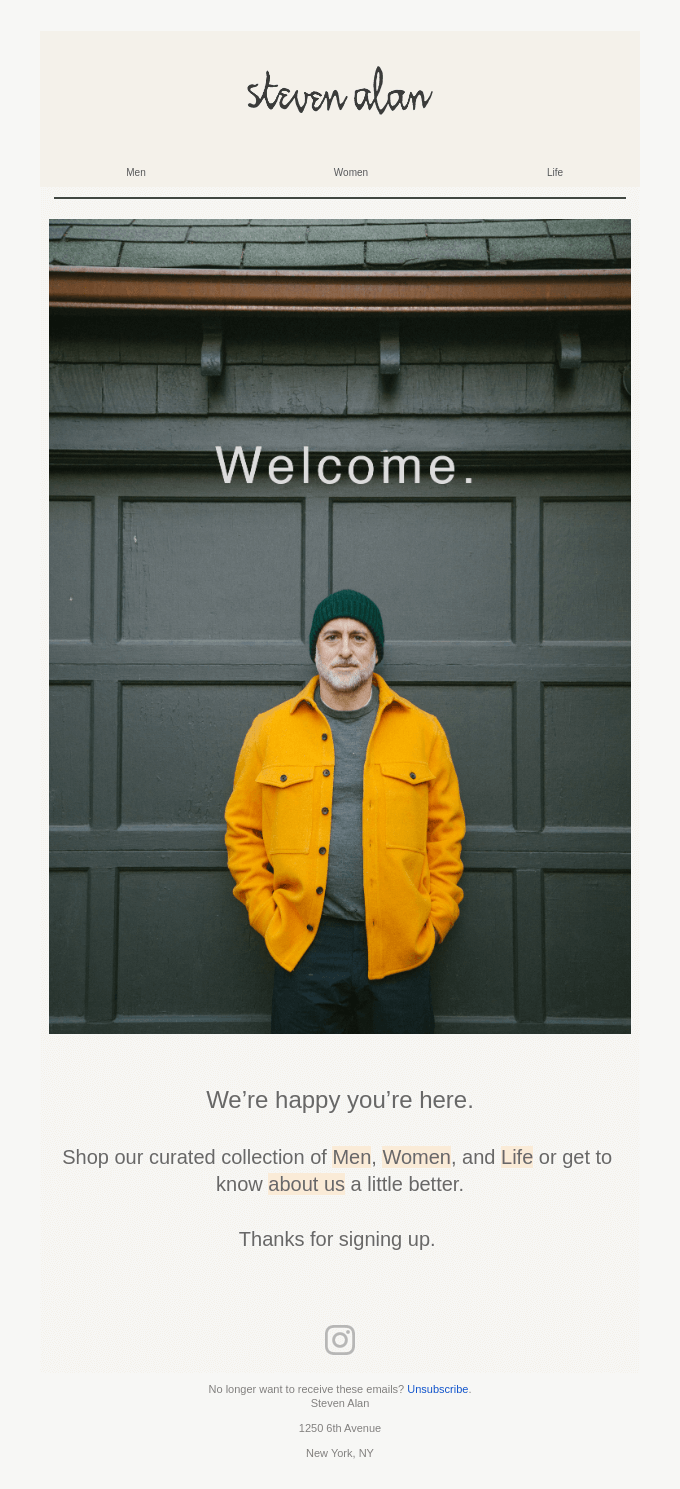

Automated Welcome Series

Trigger: Sign up for newsletter/first purchase.

When a consumer signs up for your newsletter, buys anything, or chooses to be on your contact list, you should send them a welcome sequence. Welcome letters from Klaviyo might feature trending or best-selling goods, as well as any other information that you believe your customers will find helpful. All of your welcome emails may be sent at once, no matter how many there are.

Welcome emails are one of the most important, as Klaviyo notes that they usually generate the most revenue. Such a campaign will have the maximum volume, which in turn requires significant optimization for the highest conversion rate. The welcome series determines the effectiveness of future emails, and its good structure will create a first impression, brand loyalty, and engagement.

Welcome flows best practices:

- To build a connection and introduce customers to your brand, focus on storytelling to let subscribers get to know you and empathize with you.

- Introduce personalization from the very first email.

- Prepare engaging and exclusive welcome offers.

- Establish full contact with your subscribers by encouraging them to interact with you on all available channels, such as social media.

- Introduce yourself by adding reviews, recommendations, and other signals of trust from your customers.

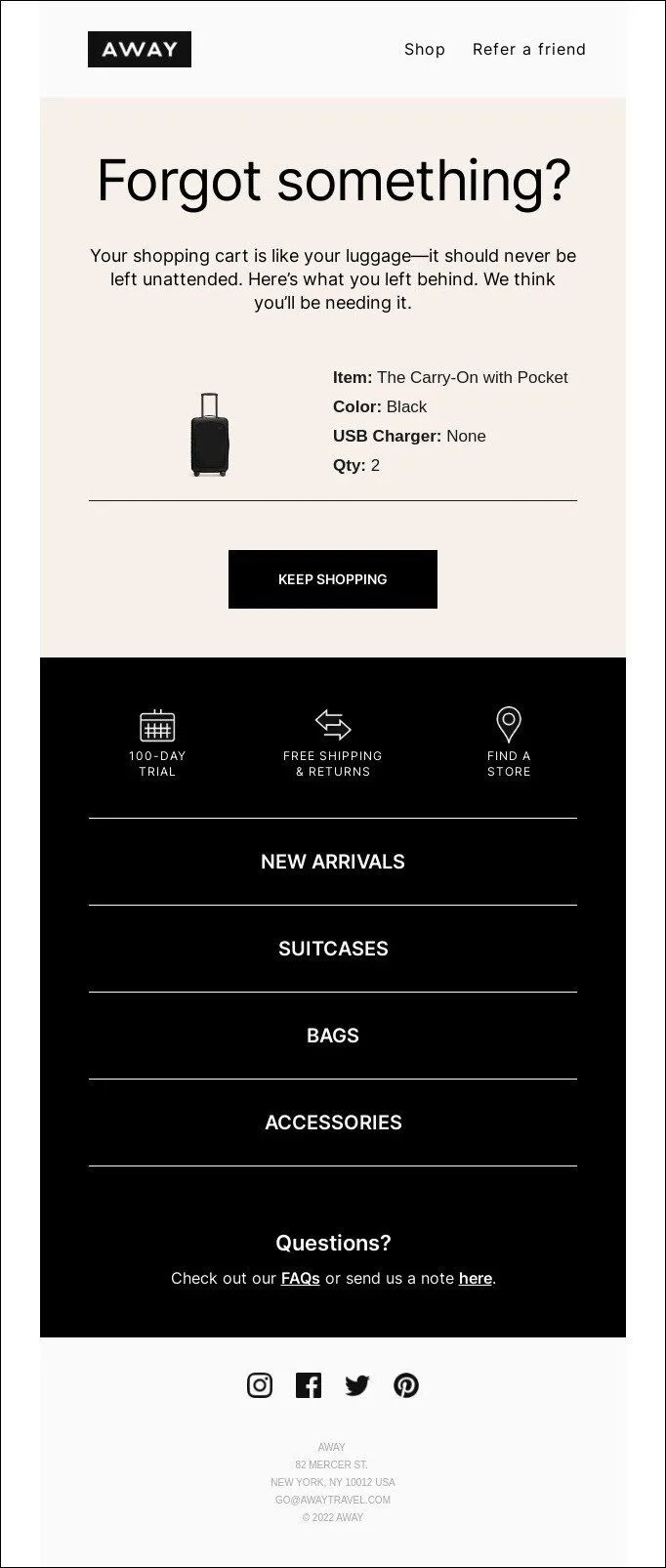

Cart Abandonment Flows

Trigger: The customer reaches the checkout page or adds items to the cart, but does not complete the purchase.

The abandoned cart email automation strategy is a common practice among ecommerce brands to re-engage customers who have not completed a purchase. These automated emails serve as a reminder, often containing personalized content such as product images and incentives to encourage customers to re-engage. Klaviyo naturally anticipated the need for personalization in abandoned cart flows, which improves customer engagement and increases revenue.

Klaviyo’s customers are experiencing significant benefits from this automation. Studies have shown that well-executed and personalized abandoned cart emails generate impressive revenue. On average, some brands get as much as $5.81 per recipient from them.

Abandoned cart flows best practices:

- Turn time to your advantage. Set your emails to be automatically sent 1–4 hours after abandonment, so your chances of customer return are higher.

- Personalization is an integral part of any effective email. Customize abandoned cart emails based on customer behavior, purchase history, and cart content.

- Don’t forget about thematic call-to-actions (CTAs). Include CTAs in your emails that make it clear what you’re asking your subscribers to do.

- If a subscriber doesn’t respond after several emails reminding them to return to the cart, offer them a special, related, limited-time discount.

Browse Abandonment Klaviyo Automation Flow

Trigger: Visitor spends some time on the product page but leaves without adding products to the cart or making a purchase.

Browsing abandonment is a Klaviyo email flow targeted at subscribed visitors who browse products but leave the website without adding anything to their cart. Their similarity to cart abandonment emails lies in their purpose, which is to bring subscribers back to the store and increase their engagement. These emails usually showcase recently viewed products and encourage users to continue browsing.

Browse abandonment flows best practices:

- Attach reviews and testimonials to the product your visitors have viewed.

- Personalize the content of your emails to specific product categories.

- You can send such emails more than once, but don’t overuse them, and avoid sending too many of them.

- Avoid using discount codes in browse abandonment emails, as they can reduce margins and get widely shared on the web.

We also have a tutorial video with step-by-step instructions on how to create a browse abandonment Klaviyo workflow, check it out below.

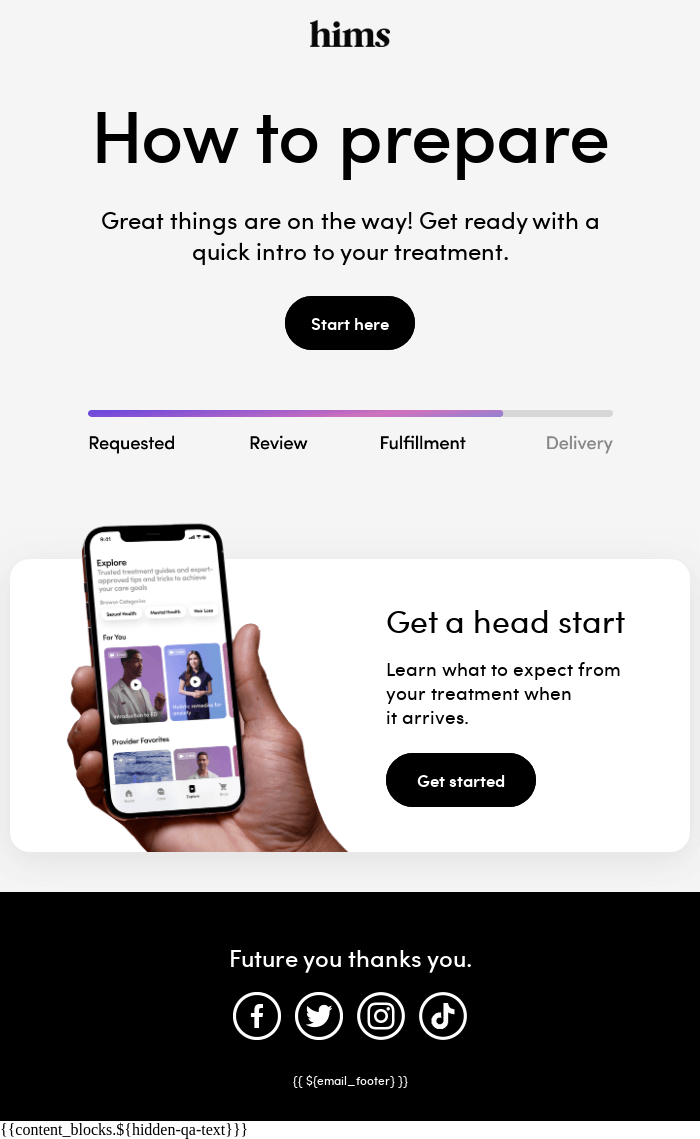

Behavior-Based Thank You Klaviyo Flow

Trigger: Customer completes the purchase and waits for the delivery.

A behavior-based thank-you flow is designed to build loyalty and extend customer lifetime value. In these Кlaviуo flows, customers are thanked for their purchase, encouraged to engage further, and in some cases receive additional key details about their purchase. We emphasize that these are not typical thank-you emails, but behavior-based emails. This means that they are more personalized as they are based on the type of customer, whether it’s a VIP or a new customer, and the emails are much more personalized thanks to Klaviyo’s segmentation tools.

Behavior-based thank you flow best practices:

- Implement segmentation in the form of personalized emails for first-time buyers, repeat buyers, and VIP customers.

- The content of the thank-you email should always include order confirmation, estimated delivery time, and customer support contact information.

- Show patience and avoid immediate repeat sales. Do not send an offer for new purchases before the product reaches the customer.

- Try adding a limited-time offer. Some brands use additional automation such as “Bounceback Flow”, in which they offer a limited-time discount as a thank you, but this thank you encourages repeat purchases.

To provide more information on Klaviyo’s post-purchase email flow, we have created this video:

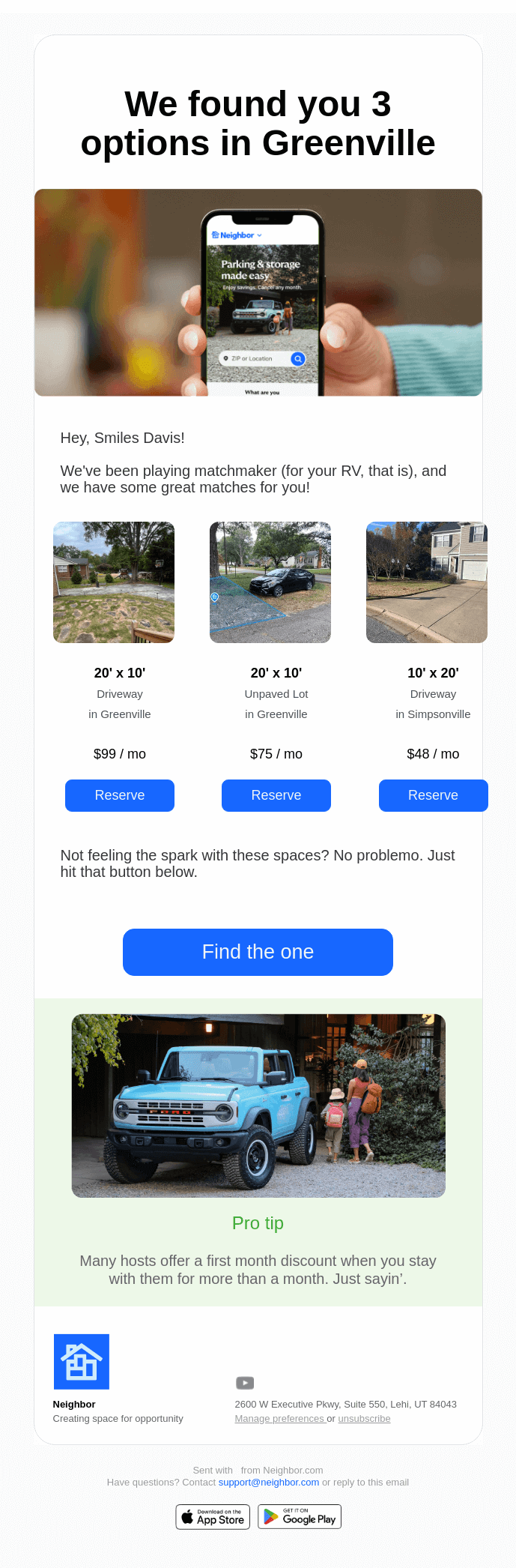

Cross-Sell Klaviyo Flow Ideas

Trigger: Subscriber has recently made a purchase or left a review about a product.

We’ve moved on from emails dedicated to the first contact with a customer, and now we’re going to talk about regular automated emails such as cross-selling. They are designed to encourage repeat purchases after the first order. The result of such a Klaviyo flow is an increase in customer lifetime value (CLV) and average order value (AOV) by recommending related products based on previous purchases. By setting up cross-selling flows, you won’t let your subscribers forget about you, your brand will stay top of mind, and you’ll increase the number of regular customers.

Cross-selling flow tips:

- First of all, use customer purchase history to recommend relevant products.

- Use cross-selling to make personalized recommendations for best-selling products.

- Optimize cross-sell automation for additional products in product collections.

- Strategize the timing and frequency of cross-sell emails. Spread emails out in 2-4 week intervals to maintain a high level of engagement without spamming receivers.

- Avoid overwhelming customers with a large number of cross-sell emails by using filters and prioritizing your inbox.

- A good subtype of cross-selling is automated replenishment emails, which means sending reminders to customers whose purchases require constant restocking.

Product Review Automation

Trigger: Customer recently purchased the product.

Another Klaviyo flow to send after a customer purchase is product review automation. It is a strategy for collecting customer feedback that will provide you with valuable user-generated content (UGC) and social proof for your brand. If you strategically plan your review requests, you can increase the chances of getting them. As a bonus, such automation will improve the customer journey by simplifying the process of providing feedback, allowing customers to easily share their experiences with minimal effort.

Note! Klaviyo doesn’t support embedded product reviews in emails, meaning that customers can’t leave reviews directly in the email they receive from you.

Product review flows best tips:

- Take your time when sending the Klaviyo review flow, give customers time to receive the product and try it out, but don’t delay it too much.

- Collaborate with review tools. To automate and efficiently display reviews, Klaviyo provides integration with such review platforms as Yotpo and Okendo.

- If a customer has received more than one product at the same time, consider asking for reviews for all of them in one email.

- Be sure to thank them for their feedback and for their time to improve your customer relationship.

Back-in-Stock Automation

Trigger: Customer subscribes to notifications about the restocking of a sold-out item/item from the wish list that becomes available again.

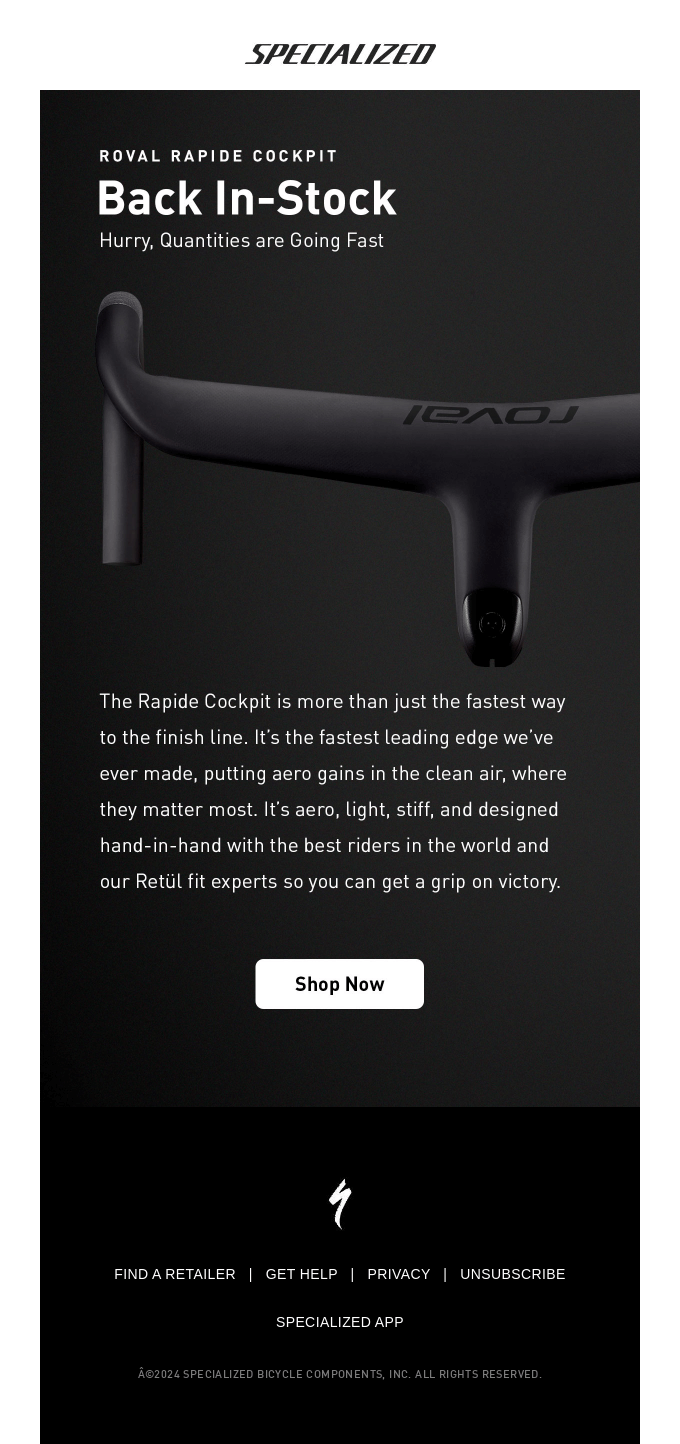

A strategy that is a good reason to send emails and notify subscribers is back-in-stock automation. It recovers lost potential purchase opportunities by notifying customers that the product they wanted is back in stock. This strategy is a good reminder to encourage customers to come back to purchase and in turn, gives customers a sense of exclusivity.

Back-in-stock practices:

- Create a sense of urgency. Emphasize that this product is actively and quickly selling out by specifying the limited stock, which will encourage immediate purchase.

- Keep your email simple so that the customer understands what you mean and doesn’t hesitate to buy.

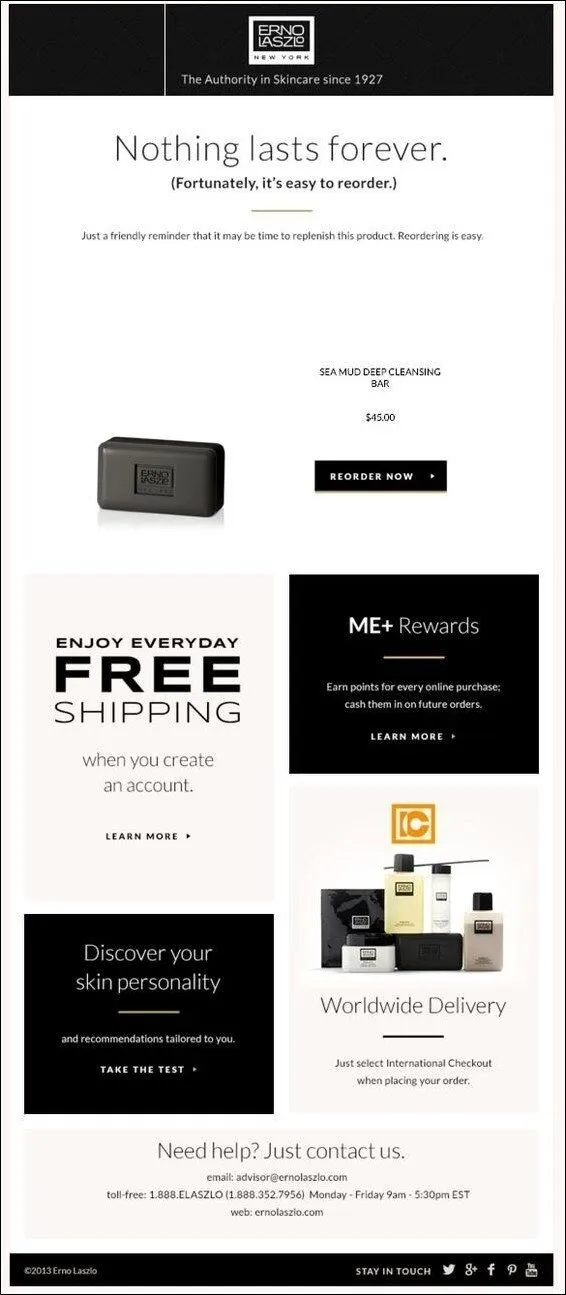

Replenishment Klaviyo Flow

Trigger: Estimated time of product expiration (for example, 30 days after purchase for a 30-day supply).

The replenishment flow defines itself, it is a flow designed for products that require regular repurchase, i.e. those that customers will constantly replenish. The essence of automation is to remind customers about the possible expiration of their stocks, encouraging them to re-order to replenish their stocks. Well-timed replenishment emails not only encourage repeat purchases but also increase customer loyalty by showing that the brand anticipates their needs.

Replenishment flow best practices:

- The main requirement of such flows is to predict the right time. Take into account the average period of product usage and customize your emails accordingly.

- Simplify emails by focusing on clear call-to-action buttons that lead directly to a pre-filled cart.

- Effectively style these emails with compelling copy and, most importantly, attractive visuals. Try to be convincing and encouraging to increase the probability of a repeat purchase.

- Organize a subscription service for such products and invite customers to sign up to receive their products automatically, regularly, and on time.

Special Events Automation

Trigger: Customer’s birthday/anniversary of their first purchase/brand events.

Special event automation is a common, popular email campaign. It allows brands to reach out to customers using their data to send timely, personalized emails. Emails in this Klaviyo flow are timed to match key customer or holiday-related moments, such as birthdays, anniversaries, or important product-related events. Personalization and exclusive offers designed to increase engagement and build loyalty are an integral part of the newsletter.

Special events flow best practices:

- Use Klaviyo’s built-in functionality to automate birthday greetings.

- Offer a holiday discount, exclusive promotion, or gift to increase engagement and exclusivity for your users.

- Try to collect as much data as possible about your customers’ important dates through registration forms.

- An important event that can be a good reason for automation is the anniversary of the first purchase or other similar events. You can advertise relevant products according to these events.

Instructional Email Automation

Trigger: Customer purchases a product that may require guidance for usage, maintenance, or assembly.

Instructional automation is essential for providing customers with the necessary guidance on how to use, care for, or ideas on how to consume certain products. With the help of instructional videos, guides, or step-by-step tutorials, emails can guide users to get the most out of their purchase while reinforcing the brand’s commitment to customer support.

Instructional flow top tips:

- To decide which products need instructions, you can research which products are most often contacted by customer support.

- Food companies can also implement a related flow, and instead of instructions, they can provide interesting food recipes.

- Try to provide the most convenient explanatory multimedia. Include tutorial videos, step-by-step instructions, or infographics to make the instructions clear and interesting.

- Consider customer questions. Answer common questions or problems that customers may encounter while using the product.

- Include a follow-up email to check if customers need further assistance or have any feedback on the service.

Winback Automation

Trigger: Customers with frequent purchases became inactive for a long time.

An automated series designed to re-engage customers who have become inactive is called Winback. It targets customers who used to make regular purchases but have been inactive for a long time. The Klaviyo winback flow offers these customers various offers to help the company get repeat purchases and retain valuable customers.

Winback automation strategies:

- Focus on segmentation, because the winback flow will be more useful if it is applied to customers with frequent purchases, and more valuable customers need more attractive offers from you.

- Exclusive offers in the winback flow should be convincing enough to bring customers back.

- The content of your winback emails can be your new, unique, trendy products to show inactive customers what they are missing.

- A strategy that works well for winback is time-sensitive offers. Create a sense of urgency with a time-limited countdown timer.

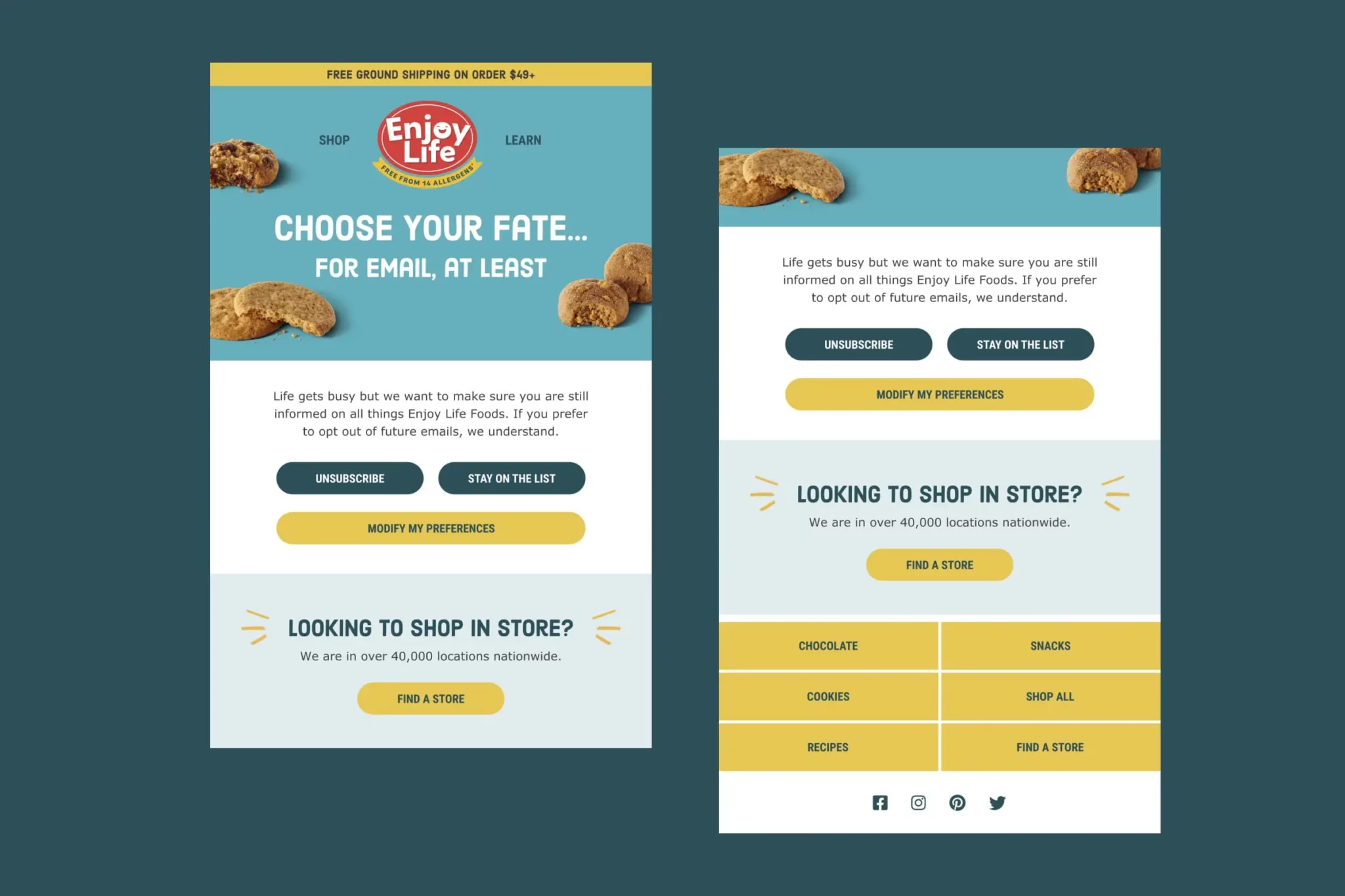

Sunset Klaviyo Flow

Trigger: Subscriber remains unengaged for a set number of days.

We couldn’t miss a very useful Klaviyo flow that brings you clear benefits such as reducing your expenses. This flow is Sunset automation, which is all about cleaning up your email list by identifying unengaged subscribers. This cleaning will allow you to reduce the cost of platforms like Klaviyo, which charges for the list of contacts. Sunset flow is a final attempt to re-engage inactive subscribers with targeted emails and special offers.

Sunset flow best practices:

- Use clear, dramatic, attention-grabbing headlines such as “Is this the end?” “Time to say goodbye”, “Last chance before we leave”.

- Offer subscribers the option to update their email preferences in case they still want to communicate but less frequently.

- Include a compelling call to action to encourage them to stay subscribed.

- Offer a discount or exclusive offer to encourage last-minute conversions.

We have also created a video explanation on the topic of the Klaviyo sunset flow. Watch it for additional information:

Transactional Flow

Trigger: Order placed/shipped.

Transactional emails are designed to provide customers with constant updates on their orders. These emails contain important purchase information such as order confirmation, shipping updates, and delivery notifications. By keeping customers informed, brands can reduce customer service calls and enhance the customer experience.

Transactional flow best practices:

- Keep customers informed at every stage of the purchase, from confirmation to delivery.

- Add useful information as email content. Share frequently asked questions or tracking details to reduce the number of support calls.

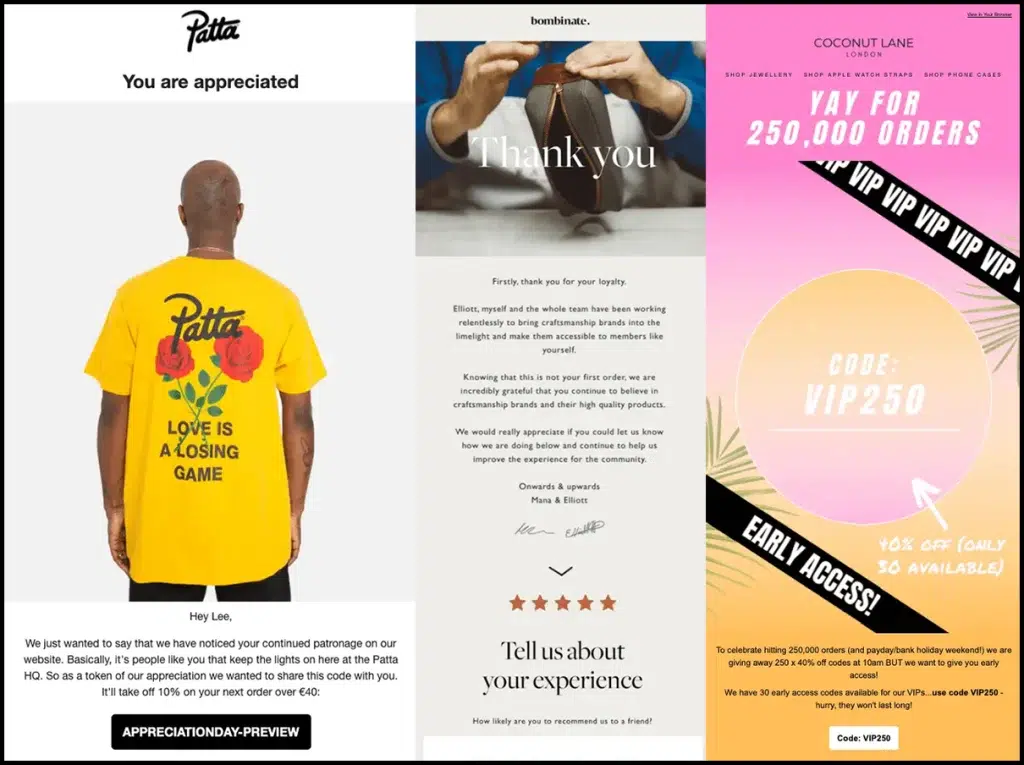

VIP Customer Flow

Trigger: Customer reaches the lifetime purchase level/spends a certain lifetime amount on your products.

Honoring your VIP customers helps you maintain relationships with your most loyal audience. Having a separate flow dedicated to VIP customers ensures that they feel valued by you, which will help extend and deepen the relationship with them.

VIP customer automation tips:

- Create an email for the moment when the customer acquires VIP status. Personalize this email in a way that makes them feel special.

- The VIP email should be sent from the name of the brand CEO.

- VIP customers should have exclusive privileges, such as early access to new products and promotions, or invitations to closed communities or events.

- Immediately give newly arrived VIP customers an overview of the exclusive offers they will receive in the future.

Zero-Party Data Flow

Trigger: Customer signs up for a newsletter.

Zero-party data flows are flows dedicated to collecting certain valuable information about customers by asking them about their preferences, interests, and needs. Practice shows that, unlike traditional data collection methods, customers are more willing to share their data in emails. This data is usually collected through quizzes, surveys, or interactive forms.

Zero-party data flow best practices:

- Customers will need an incentive to spend their time filling out a survey. Motivate participation by offering discounts, exclusive content, or special promotions in exchange for completing the survey.

- Your quizzes and surveys should be interesting, not intrusive, and make the process of completing the questionnaire enjoyable for your customers.

- To avoid the complications of creating and integrating surveys, use specialized tools for this purpose. There are platforms such as Octane AI, Typeform, and LeadQuizzes that help you create quizzes and easily integrate them with email marketing systems.

When to Send Klaviyo Email Flows?

Creating automated email campaigns requires finding the right scheduling. This scheduling should be the perfect middle way between sending too infrequently and over-sending. Choosing the right timing has a significant impact on your customers’ engagement. Here are the main criteria you should consider:

- Your audience

- Maintaining customer engagement

- Avoiding overload

Calculate the timing according to the user behavior that activates the automation trigger. The welcome email is sent instantly, the next emails in the welcome series can be sent at intervals of, for example, 5 days. When choosing the interval, you should also consider other automations that the customer may trigger. That is, the interval should provide time for other emails to be sent so that they are not sent immediately after each other. Klaviyo also offers a table of recommended sending frequencies for common flow types:

| Flow Type | Email #1 | Email #2 (first follow-up) | Email #3 (second follow-up) |

|---|---|---|---|

| Welcome series | Immediately | 4 days | |

| Abandoned cart | 4 hours | 1 day | |

| Browse abandonment | 2 hours | ||

| Post-purchase | Immediately | 3 days | 1 week |

| Winback | 60 days | 90 days | |

| Anniversary | 365 days | ||

| Sunset | 1 day | 1 week | 2 weeks |

Keep in mind that while these frequencies are a good schedule, they are just an example and will vary from brand to brand. You will need to experiment with different email frequencies, which you can easily implement with Klaviyo. Klaviyo offers a practical A/B testing feature that allows you to test not only different intervals but also the performance of your emails in general.

This way, you will get valuable information for further optimization. This information can be obtained based on click-through and conversion rates and help you determine the best strategy for your audience. By engaging in continuous testing and data-driven optimization, you will significantly increase the effectiveness of your email marketing.

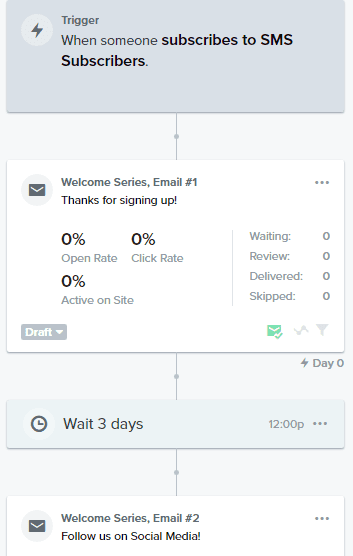

How to Set Up Klaviyo Automation Flow

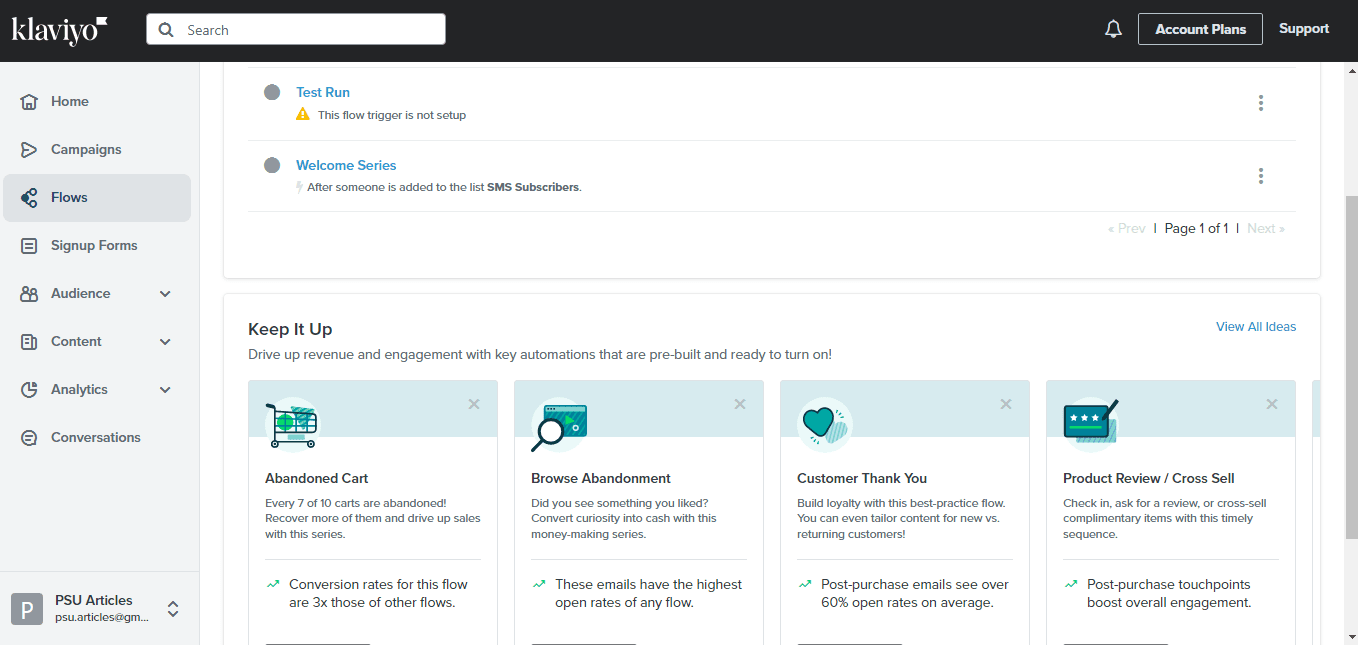

Klaviyo is a user-friendly software with preset visual guides and step-by-step templates. Once you have registered on the platform, you will have access to the Klaviyo dashboard, where you will find the “Flows” section on the left toolbar.

Ready-Made Automations in Klaviyo

The “Flows” page contains optimized and tested ready-made automation templates. You can use them right away with the content offered by Klaviyo, or you can remove the pre-built content and create your own flow from scratch.

For starters, Klaviyo offers six automated campaigns that most ecommerce brands focus on. However, you won’t be limited to just these campaigns. These are the basic types of flows:

- Welcome email series

- Thank-you series

- Abandoned cart series

- Product review series

- Browse abandonment series

- Winback series

To search for more ideas, you can open the library of already made flows by clicking on the “Browsе Іdeas”.

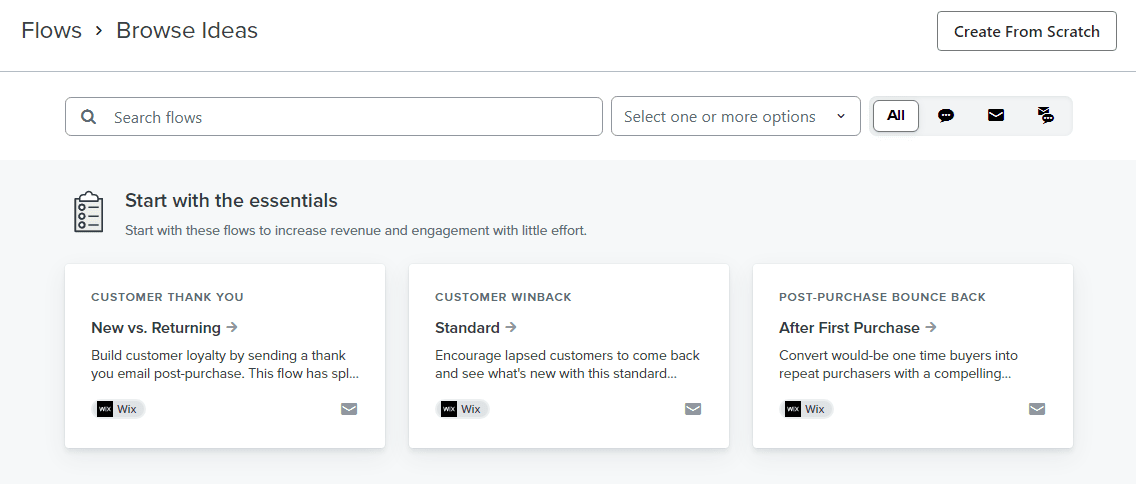

As you can see in the picture below, you can find different flows for different purposes in the library. If none of the templates are suitable for you, you can see the “create from scratch” button on this page to create your own customized flow. Keep in mind, that if you create a flow from scratch, it will require A/B testing and other test campaigns to verify the effectiveness that the pre-built flows already have.

In the library, you can use the search bar to find flows. You can also filter flows based on particular ecommerce integrations by clicking on the integration option and selecting the ecommerce platform.

Klaviyo shows only flows that are compatible with all platforms by default, but if you scroll down the page, you will find a section called “Browse by Goal” that will give you even more options for searching.

Creating a Flow

When you click on the “Create from scratch” button, you will first need to enter a name for the flow and attach a tag to it for easier identification. The most important part will be choosing a trigger, and there are several types:

- Changes in the list

The trigger for changes in the list is activated based on how the contacts in the list change. The most common example is when a customer is added to the list and a series of welcome emails are instantly sent to that customer.

- Changes in the segment

This trigger is very similar to the previous one, but instead of a contact list, a certain segment is used. This segment can be, for example, a VIP segment, where a subscriber will immediately receive an email about becoming a VIP after being added to the segment.

- Metrics

No less common are metric triggers that interact with analytics tools. These triggers include abandoned carts, browse abandonment, post-purchase emails, and product reviews.

- Date trigger

A trigger based on the “Date” feature launches emails on the dates you need. Date triggers are used to send emails on the celebration of birthdays, subscription anniversaries, and other events.

Customizing Klaviyo Flow Components

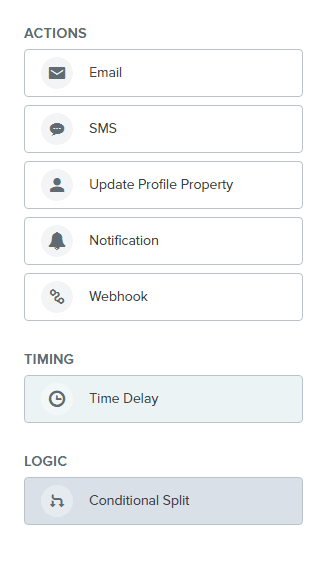

Next, you will need to customize the components according to your needs, including Action, Time Delay, and Logic.

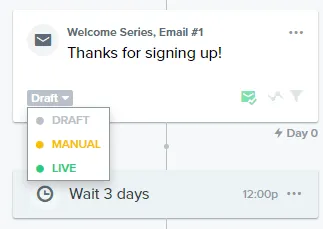

Action component

Customizable action components will conduct a predefined task as soon as the trigger is activated. This task can be an automatic email or any other option. You shouldn’t forget about setting the component’s status, which we will discuss later.

Time component

In the time component, you can set a delay between the moment the trigger is activated and the corresponding action. The time delay will come in handy if you have multiple emails in your flow.

Logic component

Logic components are divided into two splits: trigger and conditional. A trigger split directs the flow of subscribers in a specific direction based on certain actions of the client. Conditional logic splits the flow into other branches based on a predefined set of criteria.

To add these components to the flow, follow these steps:

- Select a component in the sidebar and drag it to an empty canvas.

- The component will get a green border to indicate that it can be added to the flow.

- After adding it to your flow, use the action bar to customize it by adding emails, enabling smart sending, and enabling UTM tracking.

After customizing them, you shouldn’t forget to set their statuses, including Draft (the action is not yet active), Manual (the action needs to be launched manually), and Live (the action is executed automatically).

Reviewing Results of the Flow

The final step of your running flow is to monitor its performance. To track Flow performance:

- Open Flow Builder and select the desired Flow.

- Click Show Analytics in the top menu.

- Review metrics like email opens, clicks, and conversions.

Based on the results of the flow, you can pause it to make changes or delete emails that are not performing well.

Conclusion

Despite the fact that Klaviyo is a user-friendly software and provides maximum convenience and explanations when creating flows, choosing and creating an automated campaign among all the available ones on your own may not bring the expected efficiency.

We have a solution! You can contact us to avoid wasting time and effort on learning the basics of the flow. Our company has many years of experience not only with Klaviyo but also with the implementation of automation in general.