The number of online retailers available to consumers has grown significantly in recent years.

Today customers are more willing to spend money online, however, there are several companies that offer different services and products.

In order to stand out and build brand loyalty, you can opt for an eCommerce loyalty program.

What is an eCommerce Loyalty Program?

Customer retention is achieved through the use of an eCommerce loyalty program, which rewards consumers who make repeat purchases from your e-commerce shop.

Essentially, it is a strategy for client retention that is designed to:

- Engage your existing consumers

- Urge them to buy in larger quantities

- Urge them to check out your brand more frequently, and eventually, make purchases.

It might take the shape of discounts, coupons, rebates, or even a free present in exchange for your business.

Although it is not required to have a loyalty rewards program, having one may have significant benefits for your business.

Best eCommerce Loyalty Programs

There are several different types of loyalty reward schemes available, the most common of which are listed here.

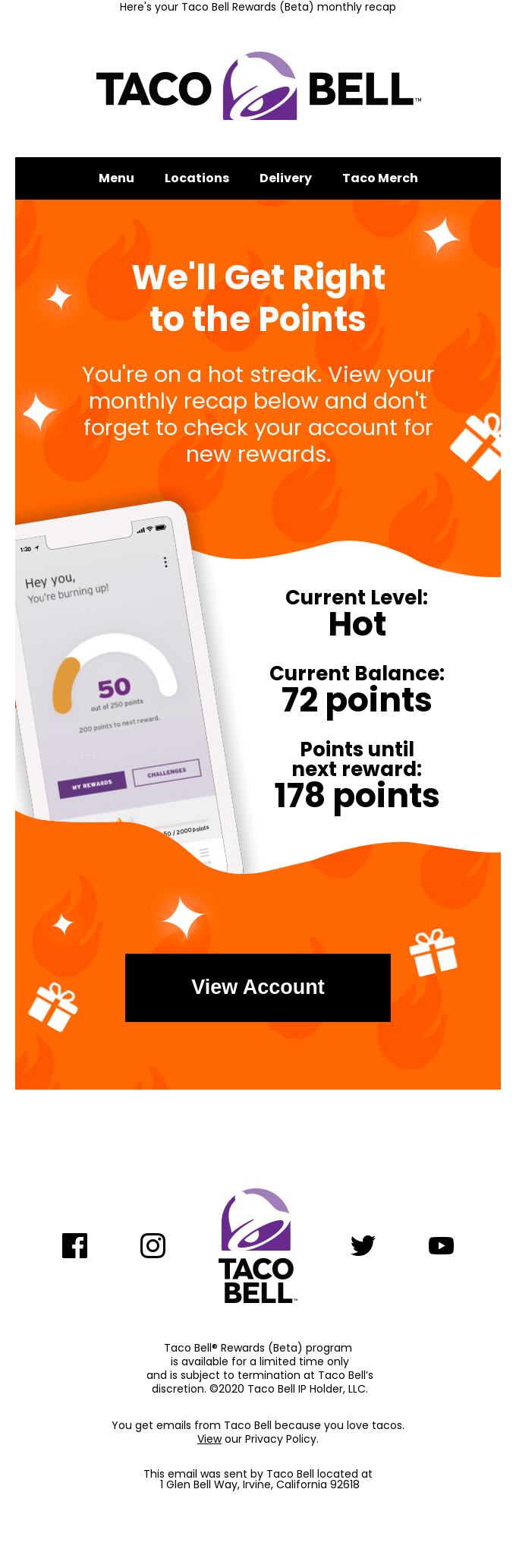

Loyalty program based on points

This is one of the most traditional forms of rewards programs, and it is still widely employed by many e-commerce businesses today.

It operates on the ‘earn and burn’ principle, which means that customers can accrue points for a variety of actions such as:

- Making a purchase transaction

- Completing their profile on your website

- Subscribing to your newsletter

- Or even sharing pages on social media sites such as Facebook, Instagram, and Twitter.

This approach of running a customer loyalty program is incredibly simple to set up and administer.

Tier-based loyalty schemes

Due to the fact that clients may go from one tier to the next, this sort of scheme is quite popular among many online buyers.

Increased advantages and higher tiers imply that consumers will receive VIP incentives, exceptional brand experiences, and exclusive benefits as a result of their membership.

Given the fact that this is a tier-based loyalty program, users will be more motivated to remain around in order to progress their status by making a continuous stream of purchases.

Programs that provide benefits

Perk schemes provide advantages to all members, without regard to whether or not they have earned points.

If you are just wanting to promote goodwill among your consumers or if you have a one-of-a-kind service to provide, offering perks is an excellent strategy.

This program type is perfect for companies who want to make the shopping experience more joyful or want to raise awareness of their brand among consumers.

Programs that are a hybrid of the above

When it comes to customer loyalty programs, eCommerce organizations sometimes typically opt for a hybrid approach, combining aspects of the points-based system with components of the tier-based system as well as other perks in order to enhance efficiency and drive certain KPIs.

This involves the incorporation of loyalty logic such as:

- Challenges

- Badges

- Loyalty clubs.

Pros and Cons of an eCommerce Loyalty Rewards Program

Pros of using eCommerce loyalty rewards programs are:

- You can attract new members and keep them loyal, which is the primary goal of loyalty programs.

- Repeat customers save you money and increase profitability since new customers cost five times as much as returning customers.

- Your consumers are more likely to try out new items or services if you have a loyalty program in place.

- Loyal consumers may also assist in bringing in new customers through word-of-mouth suggestions and readily engage in referral programs if the company is effective.

Cons:

- Loyalty programs are used by a wide range of organizations, and in some cases, they may be very similar. You need to spend much more time and research creating a unique program.

- Brand loyal customers and repeat customers are often difficult to tell apart. The fact that a customer buys from your company on a regular basis does not guarantee they are devoted to your product or service. They may be buying it because of the incentives you’re providing them.

- In order to get a complete picture of clients’ purchasing habits, loyalty program data might be rather limiting. Customers may be reluctant to give up personal information in order to take advantage of the program’s rewards.

Ways to implement an eCommerce Loyalty Rewards Program

Setting up a customer loyalty programme appears to be a difficult task.

However, with a few simple steps, you can have yours up and running in no time, whether you are a new company or have been in business for a while.

Select the type of reward you wish to give

It is critical to first consider what will motivate your consumers to continue to support your company’s products or services.

You might experiment with a variety of alternatives like:

- Discounts

- Points

- Free delivery

- Exclusive items

- And other perks.

A point-based system aids in the achievement of break-even. Consider using an email workflow system that will allow you to reward your customers.

Make use of customer retention and incentives software

With the use of software, an e-commerce shop can effortlessly set up a customer loyalty program.

Using software will allow you to create and launch a customer loyalty program in a matter of minutes.

Due to the software’s ability to supply you with information on your customers’ browsing and purchase activity, as well as the number of loyal clients you have, you may easily automate the rewarding process.

Increasing the visibility of your customer loyalty program

If no one is aware that your loyalty program exists, they will be unable to participate.

In order to raise awareness of your loyalty rewards program while also encouraging new consumers to make purchases from your e-commerce site, you must advertise it aggressively.

Sending out emails and developing landing pages on your website are both excellent strategies to advertise your program to potential participants. Many specialists are ready to assist you if you do not have the time or desire to outsource this task to those who do.

Don’t forget to personalize your loyalty program, since customers are more likely to engage with your company when they feel they know who they are dealing with.

In addition to this, you may utilize social media marketing to draw attention to your website and emphasize benefits on your website itself.