Improving your customer lifetime value and increasing it can be a goal worth working towards.

Customer lifetime value (CLV) is one of the most important metrics to help determine the success of your business. In fact, it’s one of those metrics that you simply cannot overlook, especially if you run an eCommerce business.

That’s because CLV helps you establish how profitable an individual customer is and how much money they bring to your company.

You can use CLV to make better business decisions in terms of pricing products and services, understanding customer behavior, and boosting the effectiveness of your marketing efforts.

But even though CLV is such an important metric, not many business owners fully understand what it is, how to calculate it, or how to increase it.

In fact, a study by Criteo has found that only 34% of business owners were fully aware of CLV and its connotations. In comparison, only 24% claimed that their company is monitoring CLV effectively.

So, in this article, we’ll discuss everything you need to know about customer lifetime value, from what it is and how to calculate it to effective strategies you can use to increase it.

What Is Customer Lifetime Value (CLV)?

As an eCommerce business owner, you have probably heard about CLV. But do you know what it means? To make sure we’re on the same page, let’s define customer lifetime value.

Customer Lifetime Value definition states that, in essence, it’s the prognostication of the total profit a customer will likely generate over the entire duration of their relationship with a company.

💡 In other words, Customer Lifetime Value (CLV) is a measurement that estimates how much money you will earn from each customer over the entire period they are a customer.

It’s important to reiterate that CLV does not represent the total amount of money a person has spent with you but rather an estimate of how much they’ll likely spend in total over their lifetime as customers.

CLV should be measured and monitored regularly, especially if you have a multi-year-long relationship with your customers.

However, when it comes to eCommerce businesses, increasing their CLV is often closely related to improving customer loyalty and satisfaction and encouraging customers to buy from their store repeatedly.

Why Is Customer Lifetime Value Important?

Customer lifetime value is an important metric because it allows companies to quantify the long-term value of customers.

This is especially true for subscription businesses with recurring revenue streams or companies selling products with expensive up-front costs that must be recovered over time.

In fact, there are multiple reasons why CLV is so important that many companies use it as one of their KPIs (Key Performance Indicators).

High CLV means higher revenue

Calculating CLV is important because it allows business owners to see how much profit they’re making from each customer during their relationship, which provides valuable data for their marketing and sales efforts.

A high CLV means that your customers leave a lot of money at your store, likely by shopping regularly or purchasing higher-priced items. That’s great news! The more customers spend with you, the more revenue you’ll make.

On the other hand, a low CLV means that customers aren’t willing to spend their money at your store, prefer to buy low-priced items over high-priced ones, or consistently wait for sales and discounts to buy something from you.

💡 Another of the many customer lifetime value benefits is that tracking CLV over time helps businesses see how changes in their business model affect their profits from their customers.

CLV affects your customer acquisition costs

The higher the CLV, the more valuable each customer becomes. This means you can focus on retaining existing customers more than acquiring new ones. It also lets you know exactly what types of customers spend more so you can target similar customers with your marketing campaigns.

If you know how much each customer is worth over time and compare that figure to your customer acquisition cost (CAC), then it becomes easier to see which marketing channels are working best for you overall.

On the other hand, a low CLV means you’re not getting enough value from current customers. If so, the best move for you would be to focus on acquiring new customers instead of wasting time trying to retain customers who aren’t bringing you enough revenue.

Calculating CLV helps increase customer loyalty and retention

Moreover, monitoring the CLV of your eCommerce business may help you determine what makes customers stay with you rather than buy similar products from a different shop. If you’re able to find the early signs of customer attrition, you’re more likely to find a way to retain them before they churn.

Calculating CLV helps increase customer loyalty and retention because it helps businesses identify patterns in the way their customers interact with them — especially positive ones.

💡 All in all, the importance of customer lifetime value lies in the fact that it helps businesses identify opportunities to reduce customer churn and increase profitability.

Customer Lifetime Value Prediction Models

A customer lifetime value model is a way to calculate the revenues and profits that a company expects to receive from a customer over their lifetime as a result of their relationship.

This can be useful for making decisions about which customers to prioritize, how much to spend on marketing, and how much to spend on customer service.

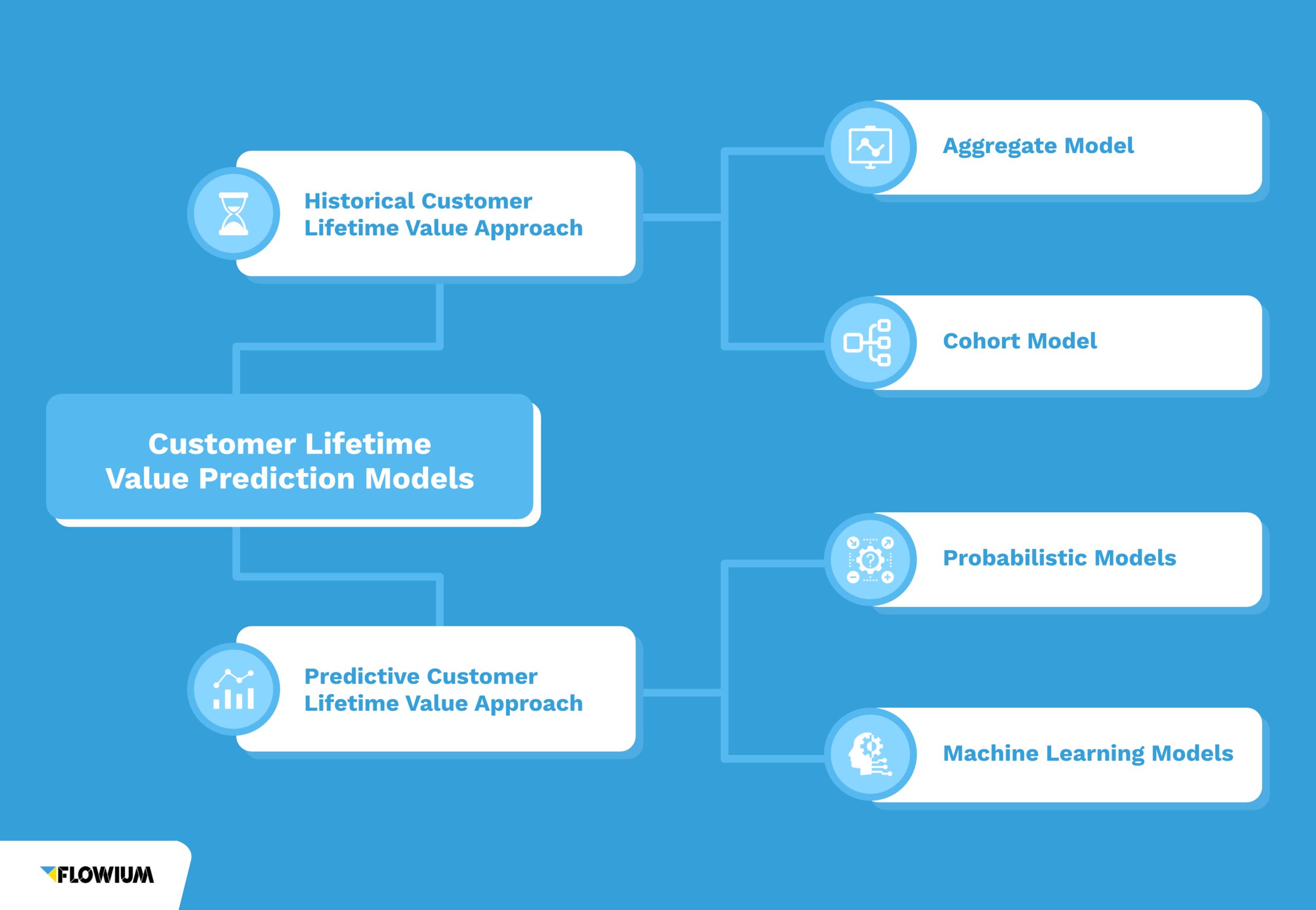

There are two main types of customer lifetime value models: predictive and historical.

The predictive CLV models use current data to predict your future CLV. They can be used to predict how much each customer will spend over a given period or their entire lifespan.

On the other hand, historic CLV models use past data to calculate how much customers spent in total over their lifetime. They can be used to calculate average revenue per customer but not necessarily predict with accuracy how much each individual customer will spend over time.

💡 While these two CLV prediction models may seem quite similar, the main difference between them is that historical models are great for understanding your current performance, but they are less accurate at predicting the future than predictive CLV models are.

Whether the predictive or the historical approach is the suitable CLV calculation model for you will depend on your business data.

Historical Customer Lifetime Value Approach

There are two historical customer lifetime value models: the aggregate model and the cohort model. Both of these are straightforward to calculate but can have several drawbacks.

The main disadvantage of the historical models is that they assume that all new customers and their spending are equal to the average spending of past customers, which may not always be the case and may lead to false assumptions.

Aggregate Model

The aggregate model is the oldest, the simplest, and the most common way to calculate CLV. It uses constant average spend and churn rates per customer and produces a single CLV for all customers.

Since this method is simplified, it has a few drawbacks. For starters, this method doesn’t differentiate between customers.

This may lead to inaccurate CLV predictions, as it doesn’t take into account the differences between groups of customers, such as seasonal spenders or big spenders, which can significantly affect the average spend per customer.

Cohort Model

The cohort model is similar to the aggregate model but eliminates its main drawback.

As the name suggests, the cohort model divides the customers into different cohorts or groups. It assumes that the customers within each group have similar spending habits and behavior.

The main question of this model is how to effectively group customers. The simplest way is to group them by the start date of their relationship with your business, for example, by month, quarter, or year.

💡 Creating cohorts by month is the most popular approach, as it effectively takes into account seasonal peaks and troughs.

Predictive Customer Lifetime Value Approach

Predictive CLV models are based on current spending patterns and predict how much money a customer will spend in the future using regression and machine learning.

They are based on historical data about what has happened in the past but use more advanced algorithms to predict future data than straightforward historical models.

There are two predictive CLV models: the probabilistic model and the machine learning model. They’re both quite complex to calculate and require data science knowledge.

Probabilistic Models

The probabilistic models (there are several) use the principles of probabilistic distribution to predict future CLV with more accuracy, including other CLV parameters, such as the number of future transactions or the future monetary value.

There are 5 main probabilistic models:

- Pareto/NBD Model

- BG/NBD Model

- MBG/NBD Model

- BG/BB Model

- Gamma-Gamma Model

The BG/NBD and Gamma-Gamma models are the most commonly used ones.

Machine Learning Models

The Machine Learning (ML) models are the most effective models to predict future CLV with the most accuracy.

That’s because these models use complex algorithms, which can determine patterns in your data and use them to forecast future customer behavior.

💡 The ML models can also accurately determine the RFM (Recency, Frequency, and Monetary Value) for future transactions.

How to Calculate Customer Lifetime Value

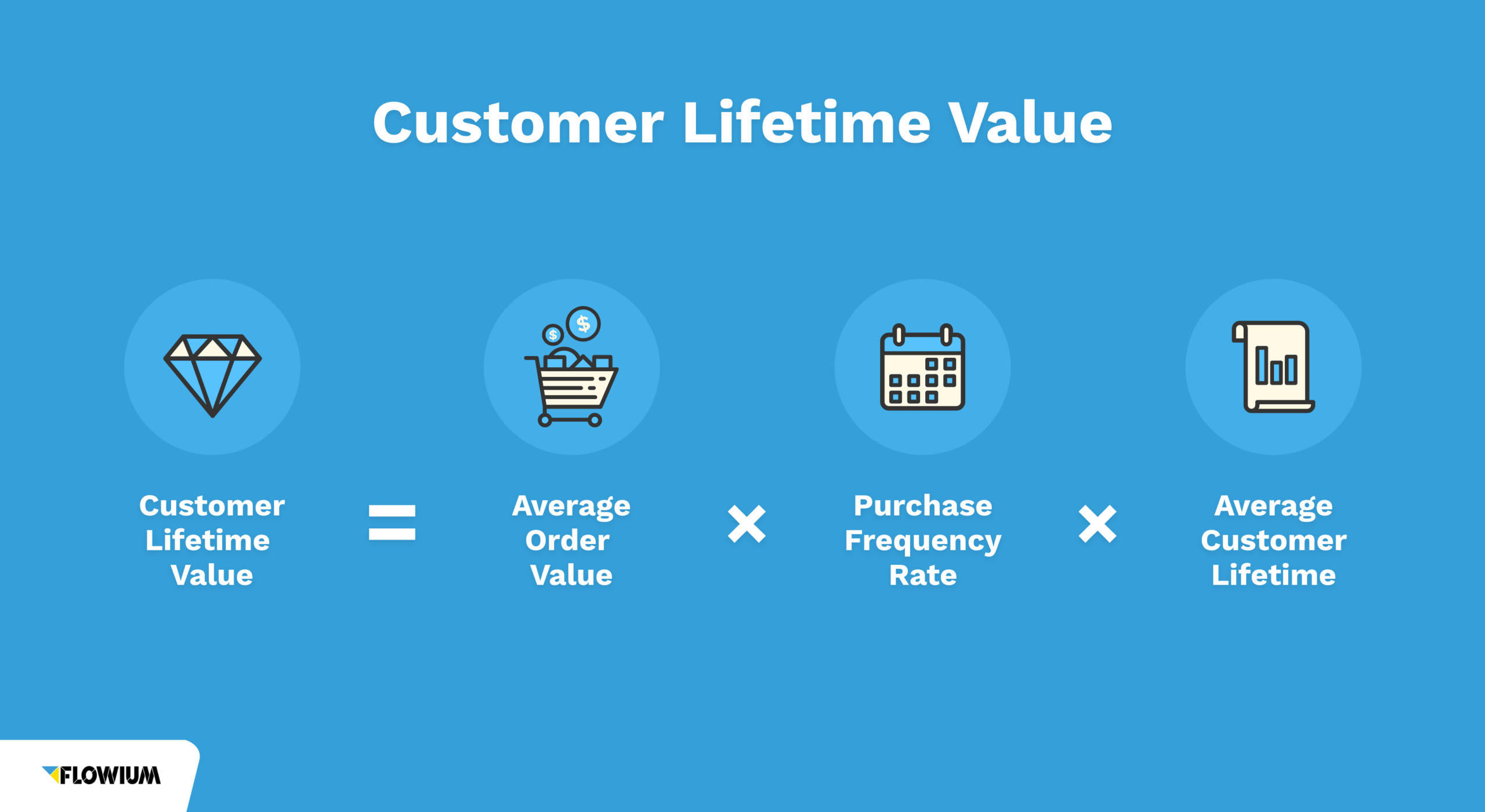

The CLV formula measures the total value of a customer over their lifetime, which you can use to compare the cost of acquiring new customers with the revenue they produce over their entire relationship with your brand.

If you’re not sure how to calculate the lifetime value of a customer, you’re in the right place. We’ll walk you through the process of calculating customer lifetime value below.

Steps to Calculate CLV

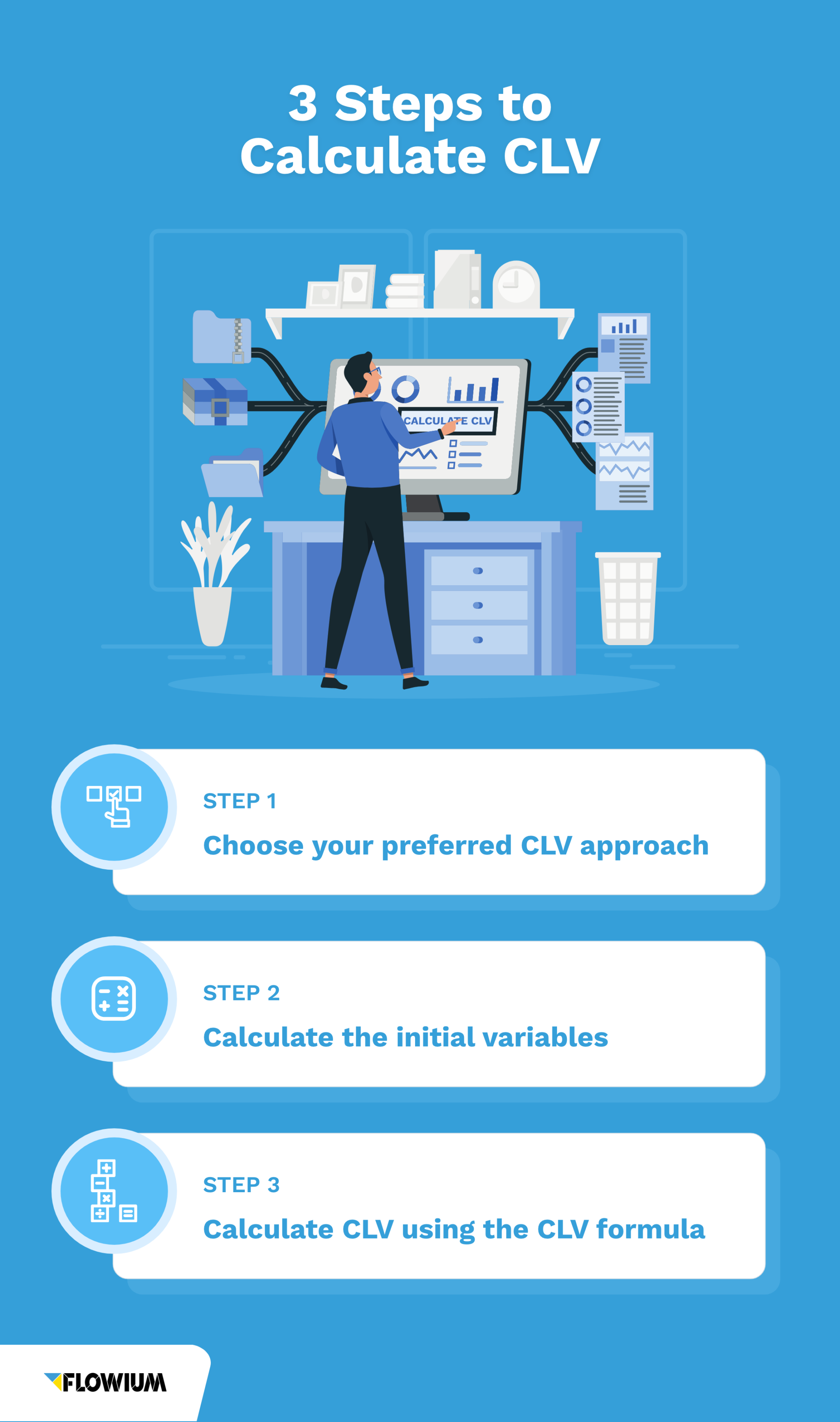

To calculate customer lifetime value, follow these steps:

Step 1: Choose your preferred CLV approach

By now, you know that there are several CLV calculation models. Before you jump into the magic formula for CLV, you need to decide which approach is the best for you.

The historical models are much easier to calculate, which is why they’re the most common way companies calculate their CLV.

However, if you decide to use the predictive CLV models, you’ll need more accurate data, which often comes with implementing advanced analytics technologies.

For simplicity, in this guide, we’ll focus on showing you how to calculate CLV using the historical aggregate model.

Step 2: Calculate the initial variables

Before you jump straight into the customer lifetime value formula we introduce below, let’s go over a few variables that you’ll need to calculate CLV.

- Average Purchase Value (APV) or Average Order Value (AOV): This number is calculated by dividing the value of all purchases in a given period by the number of purchases throughout that period. APV shows you the average value of each customer purchase at your store.

- Average Purchase Frequency Rate (APFR), or simply Purchase Frequency (F): This number is calculated by dividing the total number of purchases during a given period of time by the number of individual customers who purchased something during that time. The APFR shows the average frequency at which the customers purchase from your store.

- Customer Value (CV): This number is calculated by multiplying the average purchase value (APV) by the average purchase frequency rate (APFR). It shows how much value, on average, each individual customer brings to your business.

- Average Customer Lifespan (ACL): This number is calculated by dividing the sum of all customers’ lifespans by the number of customers. Essentially, this is the average period of time a customer continues buying from your business. The ACL can also be calculated as one divided by the churn rate.

- Gross Margin (GM): This number is shown as a percentage and represents the profit made before deductions. It’s calculated as total sales revenue minus the cost of goods sold divided by total sales revenue.

- Churn Rate (CR): The churn rate is the percentage of customers who have stopped purchasing from your store within a given time period.

Step 3: Calculate CLV using the CLV formula

Once you’ve got all the above variables calculated, you can use one of the CLV formulas.

Customer Lifetime Value Formula

There are several ways to calculate CLV and, therefore, several formulas you can use. Some consider cost factors, such as the Gross Margin, while some don’t, which causes differences in their final value.

In this article, for the sake of simplicity, we’ll walk you through the two simplest ones. We’ll also include a real-life example for each customer lifetime value calculation.

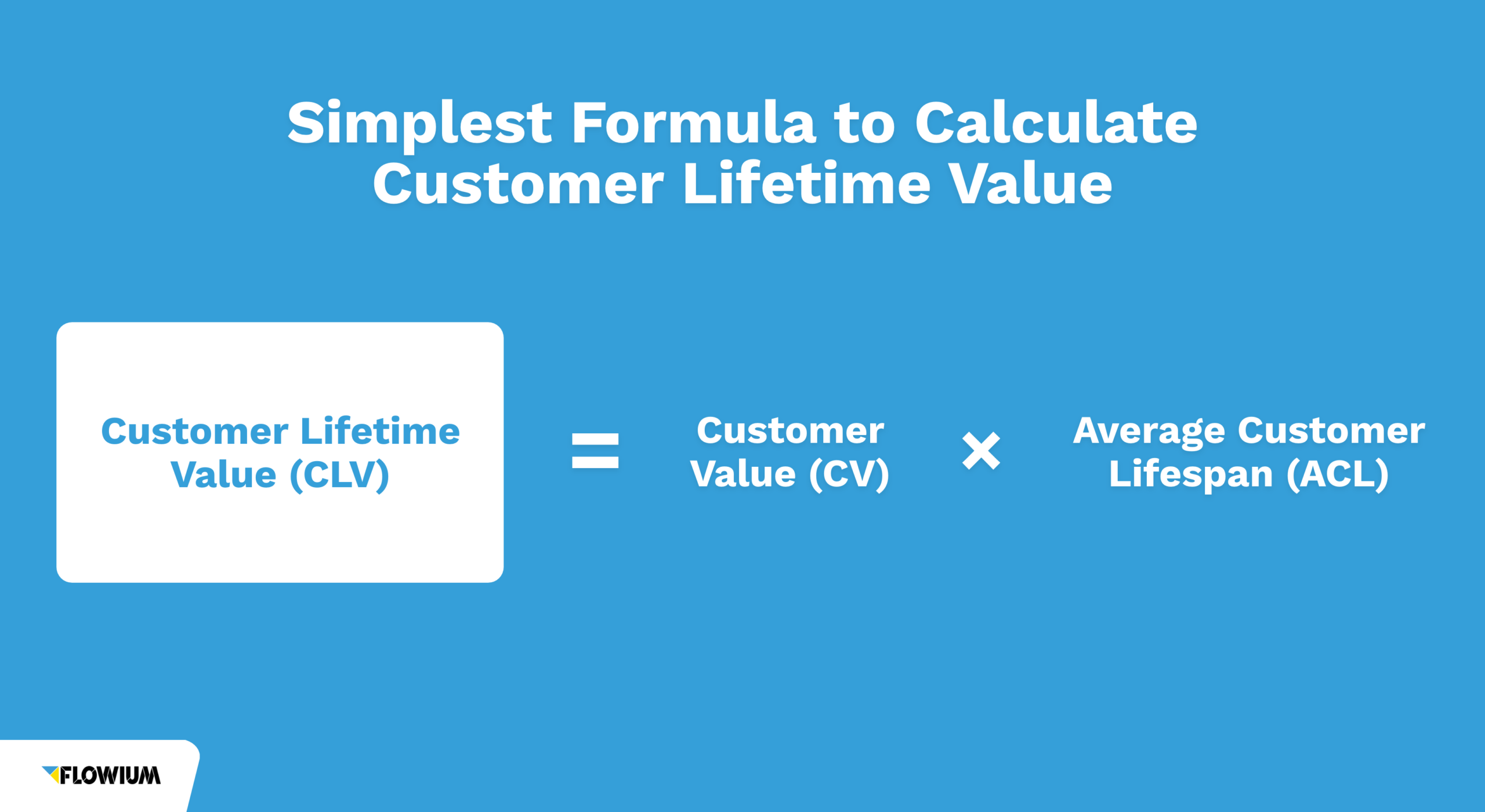

Formula 1:

The simplest formula to calculate customer lifetime value is as follows:

This formula uses historical data to calculate an average monetary value that you can expect each customer to spend at your store throughout the given period.

💡 Calculating CLV may be pretty overwhelming, given that there are many variables to take into account and many approaches you can use to calculate it. If you need help with calculating customer lifetime value for your business, you can turn to a customer lifetime value calculator.

Real-life example:

Let’s assume that you’re the owner of an eCommerce store that sells coffee from all around the world. You already know that an average customer makes an order of around $24.40 at your store with each visit. You also know that your customers purchase from your store at an average frequency of 2 per month.

In addition, your churn rate is 20%, which means your Average Customer Lifespan (ACL) is 5 years.

So, let’s calculate your CLV.

APV = $24.40 per visit

APFR = 2 per month (24 times per year)

CV = APV * APFR = $24.40 * 2 = $48.80 per month ($585.60 per year)

CLV = CV * ACL = $48.80*12*5 = $2,928

So, an average customer will spend $2,928 at your store during their entire lifespan with you.

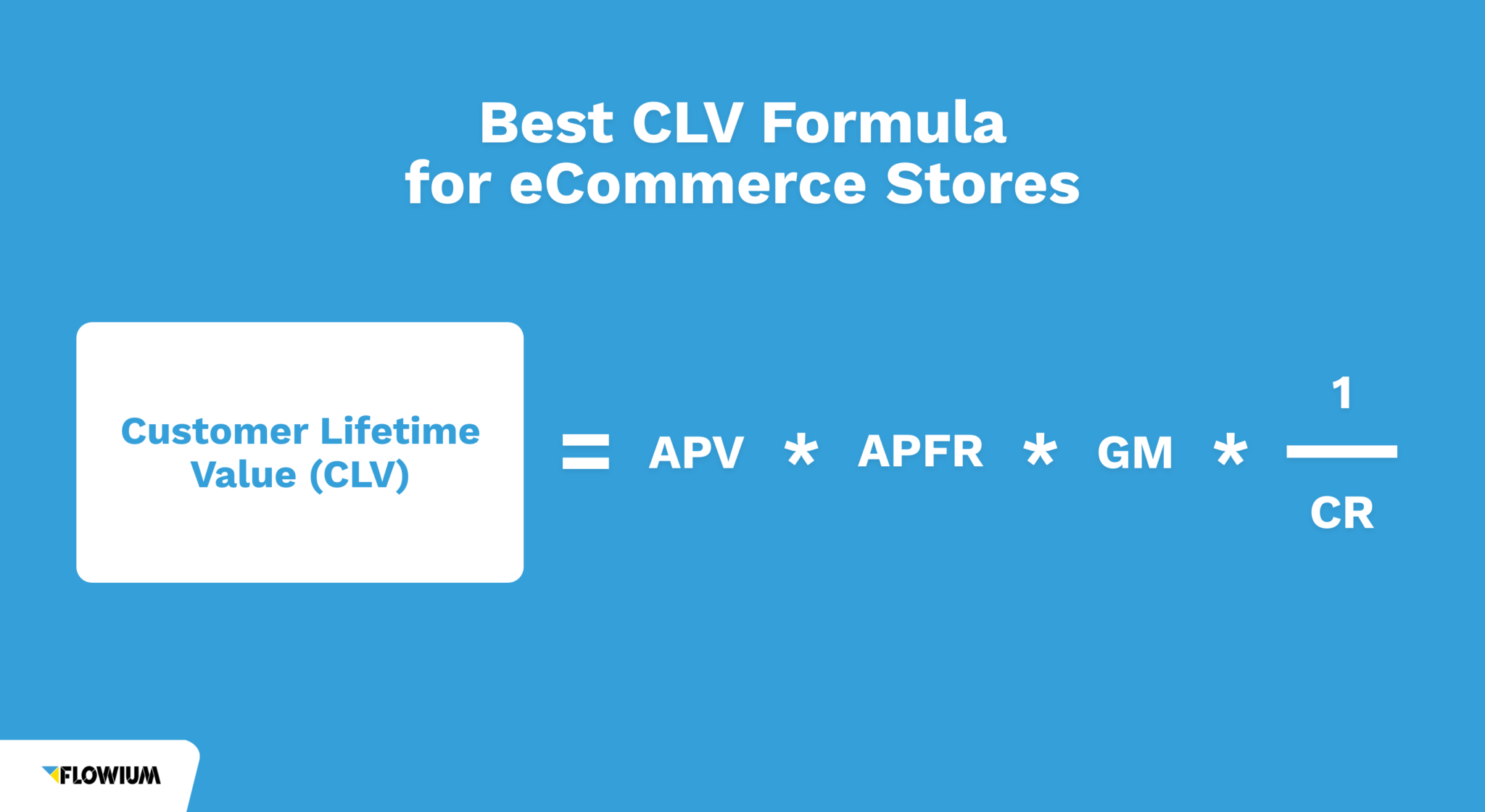

Formula 2:

The second formula for calculating customer lifetime value is as follows:

Unlike the first formula, this one considers the cost of goods sold. This calculation is more accurate for businesses that incur said costs and want to find out the gross profit each customer brings.

So, if you’re running an eCommerce store, this formula might be more suitable for you.

Real-life example:

Suppose your store made $125,000 within a year. During that period, you had 750 unique customers who made 1,000 purchases in total.

APV = $125,000/1,000 = $125

APFR = 1,000/750 = 1.33

Let’s assume that your cost of goods sold for the entire year was $25,000 and your churn rate was 20%. Therefore:

GM = ($125,000-$25,000)/$125,000 = 80%

Now, let’s calculate CLV:

CLV = 125*1.33*0.8*(1/0.2) = $665

Therefore, each individual customer is bringing $665 of gross profit, on average, during their lifespan with your business.

What Is a Good Customer Lifetime Value?

The main goal of CLV is to predict how much money a company will make from its customers over time. The higher the CLV, the more valuable your customers are to your business.

But how do you know if your CLV is high enough? What is a good customer lifetime value that you should aim for? What’s the average CLV for your industry? Let’s try to answer these questions.

Average Customer Lifetime Value by Industry

Not surprisingly, the CLV changes significantly depending on the industry. Therefore, determining the average CLV for all industries is almost impossible.

The average customer lifetime value is a pretty complex metric that requires a deeper understanding of various KPIs.

Luckily, there is a simpler version of CLV called the CLR: Customer Lifetime Revenue.

This metric doesn’t take into account different cost factors and provides the total income from the individual customer.

Here are the average customer lifetime revenues for different types of companies:

- HVAC Company: $47,200

- Busines Operations Consulting Firm: $385,800

- Digital Design Firm: $81,800

- Financial Advisory Firm: $164,000

- Commercial Insurance Company: $321,000

- Medical Billing: $88,300

- Healthcare Consulting Firm: $328,600

Customer Lifetime Value Ratio

Once you’ve calculated your CLV, there’s another important metric you need to calculate next: the customer lifetime value to customer acquisition cost ratio.

Customer Lifetime Value (CLV) to Customer Acquisition Cost (CAC) Ratio

Customer Lifetime Value to Customer Acquisition Cost Ratio (CLV:CAC) is one of the most important metrics for any eCommerce business.

CLV:CAC is the ratio between the value generated from your average customer during their lifetime with your business and the cost of acquiring that customer.

It measures the relationship between the lifetime value of your average customer and the cost of acquiring that customer.

In simple words, the CLV:CAC ratio tells you how much you’re making from your customers compared to how much you’re spending to acquire them.

This ratio is simply calculated by dividing CLV by CAC.

What is a Good CLV:CAC Ratio?

The ideal CLV:CAC ratio depends on the industry and business model, but it should be higher than 1.

The CLV:CAC ratio lower than one means you’ll be spending more money on acquiring customers than earning from them. On the other hand, the higher the ratio, the better off you are because you’re making more money from each customer than it costs to acquire them.

For example, if CLV:CAC is 3 (or 3:1), it means that for every dollar spent on acquiring a customer, you’ll make three dollars from them in the future. This is good because it means that you’ll be profitable as long as you can keep up the marketing ROI.

However, if your CLV/CAC ratio is low (less than 1), there are some things you can do to improve it by either increasing CLV or decreasing CAC (or both).

Strategies to Increase Customer Lifetime Value

At this point, you might be wondering how to increase customer lifetime value for your eCommerce store. The good news is that there are many ways to increase your customer lifetime value (CLV).

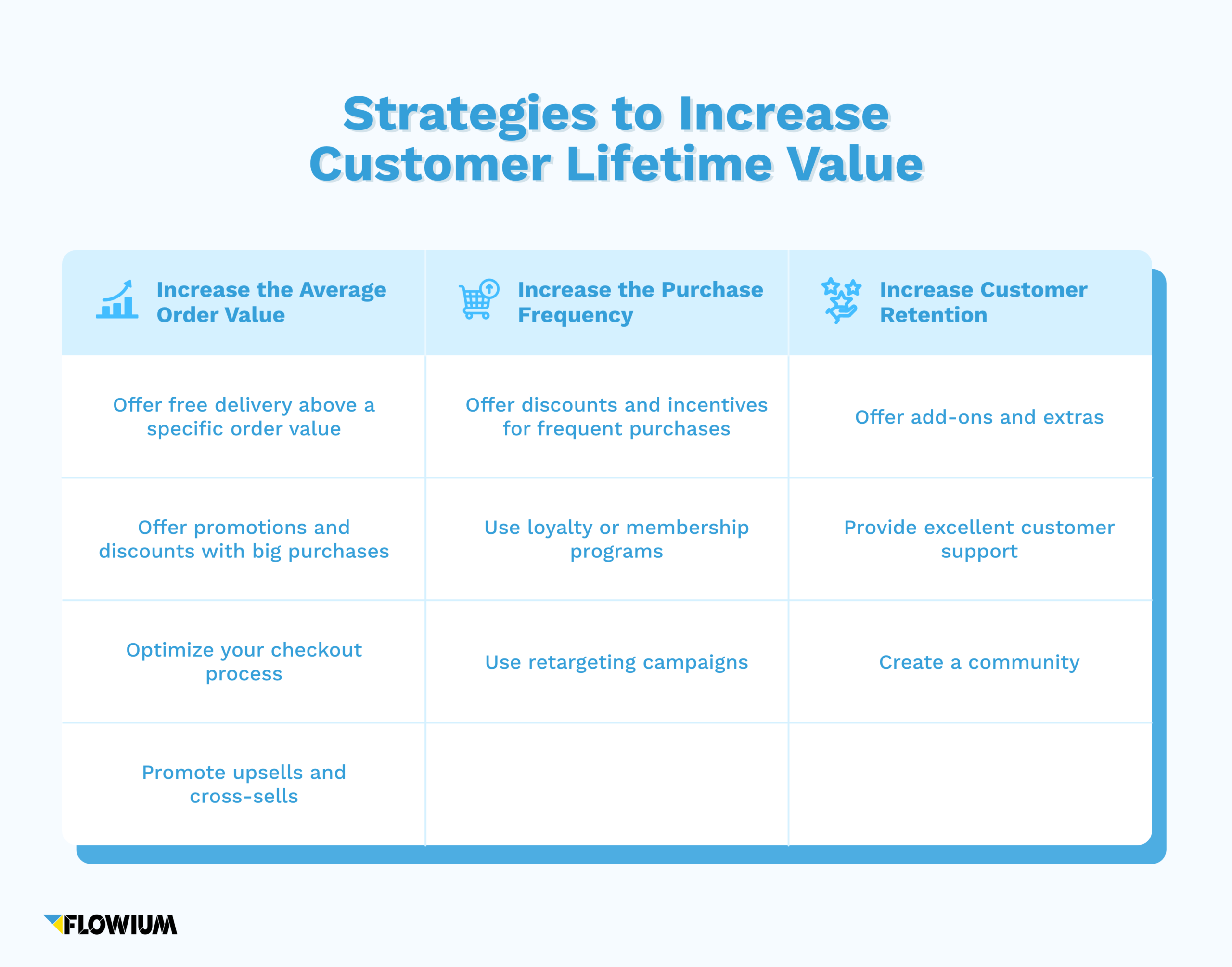

It’s not just about retaining customers but also about getting them to spend more money with you. In essence, there are three main ways to increase CLV:

- Increase the average order value (AOV) at your store

- Increase the purchase frequency at your store

- Increase customer retention and loyalty

Let’s go over some strategies you can use to increase each one of these factors.

Increase the Average Order Value

The average value of an order can be increased in two ways: by encouraging visitors to buy more items in one order or by persuading them to choose more expensive products.

Combining both is the strategy that will bring you the most benefits.

Often, achieving either of these requires just a few simple shifts that you can quickly implement into your store.

Offer free delivery above a specific order value

The best way to increase CLV is to increase the amount customers spend when they place an order.

An easy way to do this is by offering free shipping above a certain amount of order value. Often, customers will add more products to their carts just to qualify for free shipping.

Offer promotions and discounts with big purchases

Offering promo codes, discounts, or even gifts with big purchases (depending on your store, a big purchase can differ significantly).

This will encourage your customers to place bigger orders in the future because they know a reward will be waiting for them after!

Optimize your checkout process

The checkout is the most important stage in the buying process. Many customers abandon their purchases simply because the checkout process is too long, requires too many details, or doesn’t feel safe enough.

Make sure to give thought to your checkout process and optimize it effectively.

💡 Another thing you can do to encourage your customers to throw more items in their carts at the checkout stage is to have a wish list. You can prompt them to take a look at a specific item from their wish list before paying for their order.

Promote upsells and cross-sells

Upselling and cross-selling are two effective strategies for eCommerce stores to increase their revenue.

You can increase the value of their final order by encouraging your customer to buy a better, more expensive product instead of the one they’ve chosen.

Similarly, you can encourage them to purchase one more item by cross-selling a cheaper product related to the one they’ve already put in their cart.

Increase the Purchase Frequency

This is the most common way to increase CLV. If your customers buy more frequently, they’ll spend more money with you over time.

To achieve this, you need to ensure that your product or service offers enough value for them to come back again and again.

You also need to make it easy for them to do so — such as by offering a loyalty program or an app that makes it quick and simple for them to reorder when needed.

Here are a few ways to increase the purchase frequency:

Offer discounts and incentives for frequent purchases

Discounts and promo codes for frequent purchases are a great way to motivate your customers to buy from you again!

For example, if a customer buys three products in one order or makes an order of over $100, they get a 10% discount on their next purchase. This encourages them to come back again and again.

Use loyalty or membership programs

Create programs that reward frequent buyers with extra rewards and benefits such as free shipping or early access to new products.

You can also create membership programs that offer exclusive discounts based on loyalty status levels. For example, a customer with a Silver membership level gets 10% off all future purchases. This is a great way to encourage customers to purchase from your shop more often!

Use retargeting campaigns

As a marketer, you have probably heard of retargeting campaigns. It’s very likely that you’re already implementing them in your business.

Retargeting campaigns are based on past customer behavior and purchase data, which is why they’re so effective at showing the right products to the right customers.

You can leverage the power of these campaigns to encourage your customers to purchase from your store again.

Increase Customer Retention

Another way to increase CLV is to improve customer loyalty and retention. Loyal customers buy more and stay longer with a business.

As an eCommerce store owner, you can use many strategies to increase customer retention. Here are a few that we consider effective.

Offer add-ons and extras

Everyone loves surprises! And when you run an eCommerce business, surprising your customers can be as easy as offering add-ons and extras that they didn’t expect.

For example, if you sell clothing, offer gift wrapping or gift boxes, so your customers feel like they’re getting more bang for their buck when they buy from you.

The same goes for oversized products – if someone buys an item from you which is heavy or large, offer free delivery or free assembly, so they don’t have to lift it themselves!

This will make your customers feel more appreciated and increase the value of your products and your brand in their eyes.

Create a community

Brands are increasingly leveraging social media to build communities around their mission, values, and specific traits.

Create a community on a social media platform like Instagram or TikTok, where people can interact with you and each other, share their opinions, and see the behind-the-scenes of your business.

This is a great way to build stronger relationships with your existing and future customers and gain their loyalty from the start.

Provide excellent customer support

According to Zendesk, lousy customer service has caused 82% of surveyed customers to stop doing business with a particular company. This is a huge number!

As you can see, improving your customer service can significantly impact your retention rates and customer loyalty. So, make it easier for customers to get support.

Provide a convenient way for them to contact you, preferably via multiple channels (phone, email, social media, live chat), and, if possible, provide support 24/7.

💡 Train your customer service agents to be responsive and helpful, even if it’s an easy question or complaint that could be handled by the FAQ section or bot. In addition, make sure your service team knows how to answer questions and resolve problems quickly, so they don’t turn into bigger issues down the road.

Final Thoughts

Staying on top of all the important metrics for your eCommerce can be challenging. And it may not be necessary, as long as you focus on the most important ones for your business.

The customer lifetime value is one of the metrics that you shouldn’t ignore, as it can give you valuable insights into how your business is really doing.

If you’re working on increasing your CLV, implementing the strategies mentioned in this guide can help you do that. To make sure you’re getting the best results, use A/B testing and adjust your efforts to its results. We’re rooting for you!

Customer Lifetime Value FAQs

There are several formulas to calculate customer lifetime value, and choosing the right one will depend on your business model. In this article, we’ve shared two of the main CLV formulas: one that doesn’t consider the cost of goods sold and another that does.

The customer lifetime value (CLV) and the lifetime value (LTV) are two very similar metrics, and many business owners easily confuse them. However, while the difference between them may be blurred, they are not the same. The main difference between CLV and LTV is that CLV deals with individual customers, while LTV deals with aggregate customers.

A high CLV is better for business. It’s a sign that your business is profitable and you’re making money from your customers. A low CLV may indicate that your customers aren’t bringing you enough money. In addition, if your CLV:CAC ratio is less than 1, it’s a sign that your business isn’t profitable.